Although the Edge computing market has significant volume, it is still a growing and developing market. No true standards have been imposed on existing technologies. Furthermore, there are many market sectors that use Edge Computing, making it even more difficult to understand which technologies are most important for manufacturers.

Even with this uncertainty, manufacturers need to expand beyond traditional computing to cover the magnitude of production data being produced. This is especially important to combat bandwidth limitations, latency challenges, and unpredictable network disruptions.

The projections for the coming years are very optimistic. A CAGR (Compound Annual Growth Rate) of 19% is expected for the Edge computing market, which means that the market volume could be $87.3 billion USD by 2026.

For any expanding market, understanding which trends can benefit you both now or in the future are critical to setting your Edge analytics strategy. This may be by adopting competitive improvements that this market brings to our business or by directly participating in the Edge computing expansion.

Let’s explore the trends shaping how manufacturers are expected to approach Edge computing in 2023 and beyond.

1. New strategic alliances for Edge computing in manufacturing

When new markets pass the initial hype and overcome the disappointment phase, they enter the maturity phase. It is obvious that this will be the process of Edge Computing over the next few years.

In the maturity stage, a de facto standard has been imposed at a technological level on how to address the most common challenges in the market. In markets as broad as Edge computing, there might be more than one standard to cover different types of manufacturers. It may also cover a variety of challenges within the same sector.

For large manufacturers, Edge computing can be a great advantage. Specifically, it is often simpler to solve challenges close to where data is generated. There’s also the possibility of scaling the computing capacity in a more controlled way. However, the promises of plug-and-play and instant ROI require legwork.

In fact, for an Edge computing solution to be successful, several components must work together: the Edge device(s), the operating system of this team, development and configuration of the business logic, communications with the cloud, the Edge Platform, etc. We are talking about challenges such as deploying services, capturing data, debugging problems, deploying, monitoring, and managing security policies, and a long list of other functions.

There are components of an Edge analytics solution that are not always obvious yet are vital to an edge deployment in manufacturing. We refer to service development platforms, packaging offers as applications, delivery systems, remote deployment, centralized monitoring, and auditing—and all of this is integrated with the communications and security of the deployed architecture.

With everything mentioned so far, we can see the complexity of an end-to-end solution in Edge computing. It is not difficult to understand that many companies are reaching strategic agreements among themselves to cover the entire solution of what customers expect.

Some examples of these alliances are:

- Dell Technologies, the manufacturer of Edge devices, joins forces with AT&T, the telecommunications company, to develop an open-source solution in Edge that also focuses on 5G.

- Siemens hardware for factory connectivity comes preloaded with Braincube’s Edge analytics platform

- Michelin uses Neovision AI for damage recognition in real-time

The trend is clear: companies are teaming up to face the great complexity of the challenges of Edge computing. A company’s hardware is pre-loaded with another company’s software. Marketplaces are full of Edge apps from dozens of companies. Consulting services now include complete Edge implementations.

There is a need for a standard that unifies how to solve the aforementioned challenges. The maturity of the industry will ultimately decide which solutions end up being adopted.

2. Hyper-automation with Edge Analytics

Not all companies are aware of how much Edge analytics could help them. As adoption increases across manufacturing, SMEs are uncovering how Edge analytics can benefit them in their daily work. From typical tasks like monitoring and alerting to more complex studies combining real-time and historical data, Edge analytics is expanding across manufacturing.

The projection of growth and maturity of the Edge market is evident, and large corporations are taking notice. Specifically, SMEs are innovating how they can use Edge data.

More and more industrial SMEs see the need to invest in Edge analytics that allows them to be more efficient in their daily work. For example, take a manufacturing plant that has 100 assets on its shop floor. How can SMEs know where to prioritize their time without low-latency data?

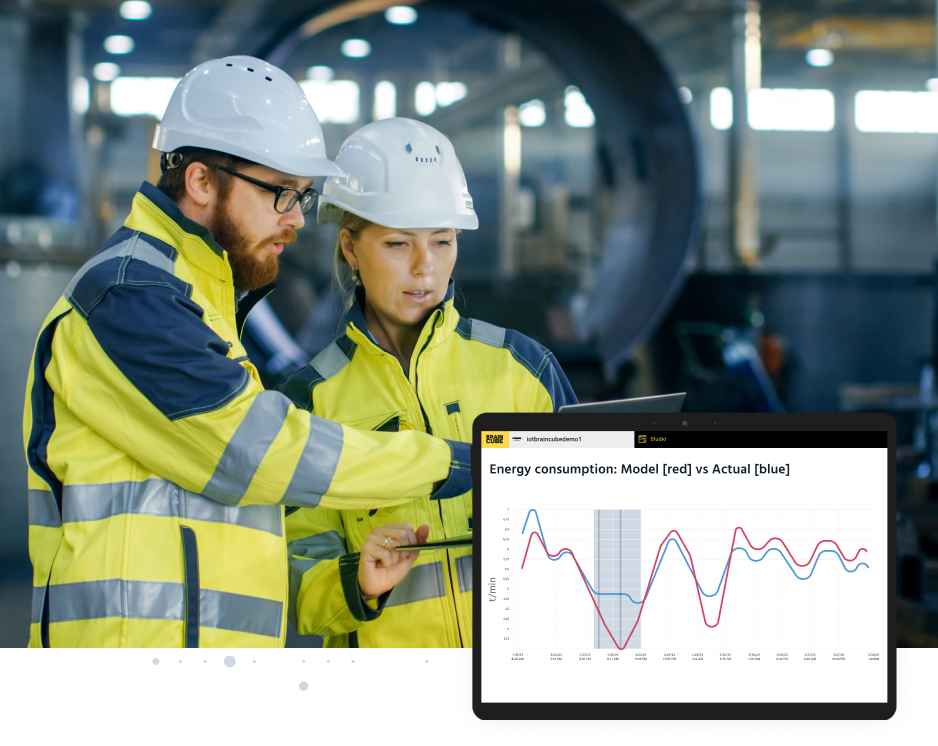

In this scenario, this company relied on Braincube for its data visualization and condition monitoring apps to increase their efficiency (including OEE) and reduce scraps through better real-time insights.

This allowed for a major shift in the way they operated: alerting, RCA, SPC, and more became automated. As a result, SMEs could spend more time on improving production.

Edge Platforms are fundamental for reducing management costs. Integration with vertical Edge computing solutions simplifies employee understanding and speeds up adoption in this type of company.

In manufacturing, real-time data analytics is essential. In current Edge computing solutions, we find specific purpose processors such as GPU (Graphical Process Unit), APU (Associative Process Unit), TPU (Tensor Processing Unit / AI Chip), FPGA (Field Programmable Gate Array), and VPU (Video Processing Unit). These chips are important as they allow manufacturers to automate highly specialized calculations quickly and efficiently close to where the data is generated.

Real-time analysis removes the need to send this information to the cloud in order to extract, transfer, or load the data into another system. Hot data can inform teams on problems as they are occurring by leveraging Edge computing for manufacturing. Using these chips, manufacturers not only extract real-time knowledge from the data collected. It also empowers teams to have more data on which to make decisions and actions based on the knowledge acquired.

Edge Computing is one of the key components of the Industrial Internet of Things (IIoT), which most manufacturers today rely on as their connectivity ecosystem of Industry 4.0. Digital transformation is moving manufacturers from the data silos of Industry 3.0 to the deep extraction of knowledge and insights from the data in Industry 4.0—and even for challengers to Industry 5.0.

Companies that have already been empowered with IoT are aware of the maintenance costs of processing large amounts of data: storage, processing, and analysis of massive amounts of data generated by sensors. SMEs are increasingly aware, as are large companies, that Edge computing is a solution to these problems.

At a reasonable cost, manufacturers can obtain numerous advantages, ranging from reducing unplanned downtime while improving production efficiency or avoiding intermittent connectivity problems and poor connectivity.

Summary

The Edge computing market is poised for expansion, yet there are still no standard solutions for how the challenges should be solved. Industry is faced with a variety of different ideas that have points in common but that can also be incompatible with existing levels of connectivity or IT architectures.

It’s possible that a de facto standard will be created to solve this situation, though waiting for this to happen has its own set of risks. In addition, as more and more SMEs leverage the advantages of Edge computing, they are advocating for the need to distribute computing outside of the cloud.